| Welcome to the Club of Amsterdam Journal. Annegien Blokpoel, founder and managing director, PerspeXo and author “Maak je bedrijf meer waard” about “Increase the value of your company”: “- Why do 80% of enterprise owners not know what the value of their company is? – Why do more than 85% of these companies have less than 10 employees?. There are more than 20 million companies in Europe, and less than 2% have more than 1.000 employees. A major challenge for European SME’s is therefore to overcome the “growth challenges” and their own personal and managerial pitfalls. To overcome – in a well risk managed way – the transformation moments is of key essence for growing on the business life cycle. In order to find out what the major challenges are, and how they could be overcome, Annegien interviewed 20 entrepeneurs and their advisors/capital providers (accountants, private equity and bankers) in the Netherlands. In her presentation she will share her know how as strategic advisor and apply the outcome of the research to practical ways of dealing with the challenges for SME’s.” In case you would like to hear more and also share your thoughts, visit our next event about the future of Values in Business on November 20. Felix Bopp, editor-in-chief |

Ups and Downs, and Mostly Ups – What Drives the Price of Oil?

By Michael Akerib, Rusconsult

The recent major increases in the price of oil and its derivatives such as gasoline, have affected all businesses. If fishermen and lorry drivers have been the most vocal in their protests, the tourism industry is just as likely to suffer from these new price levels. Higher airfares threaten to severely affect both airlines and the hospitality industry – particularly if predictions of further rises to $250 per barrel turn out to be correct. Airbus and Boeing are already feeling the sting with fears of postponement or cancellation of orders.

It is therefore important to understand the drivers behind the recent price movements.

Traditionally the factors affecting the price of oil have been grouped into fundamental, geopolitical and ‘other’ categories.

The two most important fundamental factors at present are the demand and supply balance and the value of the US dollar.

Supply and demand

While the market appears to be balanced today, the US government is convinced that an increased production would lead to lower prices. However, the Saudi government’s announcement that they would increase production from 9.5 million to 10 million barrels a day did not contribute to any dampening of the prices.

The world’s largest producer and exporter fears that if the prices maintain themselves at levels above $100/barrel, that the present recession will deepen leading to a downward price spiral that would lead to a significantly lower income for the producing countries. They also fear that a further drop in the American currency would severely affect the Saudi kingdom’s reserves. An even worse threat is that a stabilization of oil prices at a high level would spur the introduction of biofuels that would replace oil in a significant manner.

Not everyone, though, is convinced of the ability of the Saudi kingdom to increase its production levels in a sustainable manner.

The country has, until recently, been loath at opening new deposits as forecasting market demand is extremely difficult in the oil market. Some of the Saudi deposits may well contain high sulphur or heavy crudes that are difficult to sell.

Saudi Arabia plans to open the Khurais complex by 2010 – the first major oil field opened in the last 40 years – at a cost of $15 billion. This sum is small compared to the investment that would be required to develop Saudi’s potential offshore field.

Other countries too have difficulty in increasing, or even maintaining, their capacity. Thus, Russia, which accounted for 80% of the growth of supply from non-OPEC countries over the last few years, seems unable to maintain its present production level and, for the first time in the last ten years, production in the country fell. Mid-term prospects, however, are optimistic as new Siberian fields are put into production. However, global warming is affecting drilling activities in Siberia as the lack of ice makes it difficult to transport equipment as roads are non-existent on many areas.

Major investments are required to keep production at present levels. They are estimates at $1 trillion over the next 20 years for Russia alone.

Other non-OPEC countries, such as Mexico and Norway, have also been unable to sustain production levels.

More generally, production in a large number of countries is decreasing due to the age of the wells. This has led to a widespread belief in the theory of a peak in crude oil production and discovery.

The peak oil theory was first expounded in 1956 and its inventor, Mr Hubert, stated that US oil production would peak in 1970 – and it did.

Not everyone agrees, and among them the world’s leading oil consultancy – CERA. Some experts believe we are not running out of oil, but out of production capacity for a variety of reasons such as lack of investments and trained manpower.

Another important set of actors weighing on the crude oil market, and they are new compared to the traditional actors in previous oil crises, are the car drivers of the emerging economies, such as China and India, that have access to subsidized gasoline and who are therefore relatively unaffected by major rises at the pump and have thus no incentive to save fuel. Demand is increasing faster in countries with high subsidies. China alone will spend this year around $40 billion to subsidize the price of gasoline.

Indeed, the major imbalance today is on gasoline rather than crude. Refineries prefer light oil – used to produce petrol and diesel – to heavy oils that goes into the production of fuel oil used mainly for heating.

Iran, for instance, a major producer of heavy oil, stocks large quantities, that they are unable to sell, in vessels moored offshore.

Price increases in the retail market will probably lead refiners to increase their investments to treat heavy oils, and this may well decrease prices by increasing availability at the pump.

As prices of oil rise, oil producers invest some of the funds locally, expanding the economy, and thus their own oil consumption, leaving a smaller part of their output available for export. This, in turn, leads to price increases.

Prices at the pump in oil-producing states, with the notable exception of Norway, is usually tax free – it is, for instance, of US$0.20 per gallon in Venezuela – and this leads to a fairly unrestrained consumption, further reducing quantities available for export.

Even though China and India have recently increased the domestic sales price of petrol which remains, however, highly subsidized.

The elements above are exacerbated by more fundamental issues such as a lack of qualified petroleum engineers and a need for new infrastructure. Recent graduates from emerging countries are arriving on the employment market but essentially join national companies in their own countries rather than joining one of the majors.

The actors

Among the biggest players on the oil market today, are the so-called ‘new 7 sisters’ which are Aramco, CNPC, Gazprom, NIOC, Petrobras, Petronas and PdVSA.

Banks and other financial institutions such as hedge funds are also major players on the futures markets with the oil producers accounting for less than half the volume. More specifically, index funds attempt to beat certain indexes and therefore need prices to increase. The total volume invested in index funds has grown 20 times over the last five years. They see oil as a refuge from a weak dollar.

This has led some political leaders from US presidential candidate Barack Obama to India’s Petroleum Secretary to ask for the halting of oil futures trading, which they believe to be manipulated by the speculation from large institutional players. This, however, is most unlikely to happen. US regulators also consider imposing limits to trading positions, including on those taken by US investors on foreign markets.

A number of politicians have blamed ‘speculators’ who are switching their holdings from traditional assets such as stocks and bonds to oil futures, particularly on the NYMEX – the New York Mercantile Exchange. Indeed, the number of trades is twenty times bigger than it was five years ago. This represents eight times the imports of the US. However, it is not clear if speculative action is responsible for the increase in prices or rather if the increase in prices has driven speculators to the market.

The US is about to introduce legislation that would limit the positions that investors can take on futures markets.

Comparisons have been made with other commodity markets where increased activity is uncorrelated with price movements. Further, some commodities that are not traded on futures markets have risen even more abruptly than oil. Oil future traders do not take delivery of physical product and therefore cannot weigh on prices as they do not hoard product.

The US dollar

US imports and consumption are responsible for a massive transfer of capital from the US to the oil producing countries, in particular to OPEC countries which supply 40% of the world’s oil.

The drop of the US dollar against all convertible currencies has been a contributor to the price increase of the barrel of oil, producers seeking to maintain a stable price in their domestic currency.

Every increase in interest rates on the Euro led to an almost immediate increase in the price of oil, in parallel with a drop in the dollar.

The OECD scenario forecasts that the share of OPEC countries in global production will increase from the present 40% to 52% by 2030. Should the price of oil keep rising, this would translate into substantial increases in the flow of funds towards the member countries.

The fall of the dollar translates into lower income in national currency for the producing countries. Nevertheless, the rise of the oil prices has fueled an economic expansion in the Gulf and attracted more foreign workers. Due to a shortage of living space, this has, in turn, driven up rents and consequently inflation.

Since the currencies are pegged to the dollar, the oil producers in the Gulf are not free to apply an anti-inflationary policy as it would increase the value of their currency.

Kuwait has already pegged its own currency to a basket. The risk is a run on the dollar as sentiment against the currency builds.

Seen from the eyes of buyers, countries with currencies appreciating against the dollar may well be tempted to build stocks.

A global economic crisis would reduce oil needs and dollar flows from the US, thus strengthening the currency.

For the present, however, gold, which has traditionally been the traditional investment product that acts as a refuge against a falling dollar, fear of political disruption and inflation has been replaced replaced, by oil.

Geopolitical factors

The geopolitical factors include the political situation in Iran, Iraq and Nigeria, resource nationalism, sea lane security, the risk of terrorism as well as climate change.

The major fears are, of have been, in the recent past:

- the disintegration of the Middle East, whether by Turkish incursions into Iraq or by an all-out war between Shias and Sunnis

- more specifically the fragility of the Saudi monarchy, seen as the insurer of world oil production in case of shortfalls, and the possibility that Al Qaeda may gain power in that country and stop oil exports. The geographic concentration of both production (in a single large facility) and shipment (two oil terminals) makes disruption of the flow of oil possible

- supply disruptions in Nigeria

- supply disruption from Venezuela

- the fact that the vast majority of the large oil suppliers are politically unstable

- a US military intervention in Iran. The country is the world’s fourth largest oil producer but also could take action to block the Hormuz straits through which a major part of the world oil trade is channeled.

Analysts calculate that these fears have put a premium of $25 to 50 on the barrel.

Whenever fears drive markets, the latter tend to become unreasonable particularly when stocks are low and producers are unlikely to significantly increase production short term.

The future

Forecasts on the price for the next year or two vary considerably depending on the assumptions made by the forecasters, and any way forecasting the future price of oil is a perilous exercise at best. Historically, attempts at prediction have lacked precision.

The world’s population will certainly continue to increase and their mobility needs are not likely to decrease. The International Energy Agency forecasts a 35% increase in oil consumption by 2030, which translates in additional requirements of 11 billion barrels of oil.

Saudi Arabia is presently restructuring its economy to become a major producer of energy-intensive industrial products. Its energy consumption has increased by nearly 25% over the last 3 or 4 years.

It is unlikely that the uncertainty surrounding international relations will decrease and this votes in favor of sustained prices.

While the majority of the players, including the futures markets, forecast continuing price increases, some of the best known experts believe the price will inevitably drop to below $100 as recession settles in, leading to reduced demand, coupled with the introduction of biofuels and of other sources of alternative energy on a major scale. Changes in the behavior of consumers, particularly in the US, would also go in the same direction.

Further, high oil prices should encourage research for new wells and technological progress in reducing extraction costs of deposits that presently are not economically exploitable.

Another effect of high oil prices would be the slowing of the globalization process with preference given to local products which would not reflect higher transport costs.

The tourism industry has therefore entered an era of increased uncertainty calling for a wait-and-see attitude regarding new investments.

Next Event

the future of Values in Business

Thursday, November 20, 2008

Registration: 18:30-19:00, Conference: 19:00-21:15

Where: IBM Forum Amsterdam, Headquaters IBM The Netherlands, Johan Huizingalaan 765, 1066 VH Amsterdam

The conference language is English.

Supporter: IBM

The event is part of the Global Entrepreneurship Week

Our speakers are

Giuseppe Bruni, IBM Global CEO Study 2008 Program Director, Business Strategy Consultant

CEO Study 2008 Small and Medium Business Point of View

Annegien Blokpoel, founder and managing director, PerspeXo and author “Maak je bedrijf meer waard”

Increase the value of your company

Nicolas Hardinghaus, President and CEO, Hansa Real Consultants, C.A.

Strategies for Growth

Moderated by Paul Hughes, Strategic Director and Partner of Lava graphic studios, Coach to the Creative Class

Club of Amsterdam blog

| Club of Amsterdam blog http://clubofamsterdam.blogspot.com September 10: EFMN correspondents’ day 2008: Weak Signals in Foresight September 10: IBC FCPUG SuperMeet June 9 : Pakistan in the 21st Century: Vision 2030 May 24: Beyond Innovation May 24: What future coal? |

News about the Future

| carbon2go SME calculator – carbon2go calculates the carbon footprint of your business in as little as ten minutes. It covers: Utilities – consumption of electricity, water and fossil fuels such as gas and oil. Business transport – use of private and public transport, air travel and movement of freight. Staff commute – use of car, motor cycle, bus or train. Home office – the use of resources at home for the business. Other greenhouse gasses – optional for businesses that have this data. A summary of the business’ carbon emissions is produced, with those activities generating the most carbon clearly identified. |

Key indicators for Asia and the Pacific 2008 By Asian Development Bank Key Indicators 2008 features statistical data for 48 regional members of the Asian Development Bank, including Australia, Japan, and New Zealand. Purchasing power parity data are included, as are social, financial, external trade, infrastructure, governance, and environment indicators. The book carries nontechnical commentaries on the Millennium Development Goals. For ease of understanding, regional tables are grouped under seven themes (people; economy and output; money, finance, and prices; international flows; infrastructure; government and governance; and energy and environment). Each theme is introduced by a short, nontechnical writeup highlighting some key developments since the 1990s. |

Tidal power – energy from the sea

Tidal power, sometimes called tidal energy, is a form of hydropower that converts the energy of tides into electricity or other useful forms of power.

Although not yet widely used, tidal power has potential for future electricity generation. Tides are more predictable than wind energy and solar power.

Historically, tide mills have been used, both in Europe and on the Atlantic coast of the USA. The earliest occurrences date from the Middle Ages, or even from Roman times.

Tidal power is the only form of energy which derives directly from the relative motions of the Earth-Moon system, and to a lesser extent from the Earth-Sun system. Tidal energy is generated by the relative motion of the Earth, Sun and the Moon, which interact via gravitational forces. Periodic changes of water levels, and associated tidal currents, are due to the gravitational attraction by the Sun and Moon. The magnitude of the tide at a location is the result of the changing positions of the Moon and Sun relative to the Earth, the effects of Earth rotation, and the local shape of the sea floor and coastlines.

SeaGen

The world’s first commercial tidal stream generator — SeaGen — in Strangford Lough, Northern Ireland.

The technology developed by Marine Current Turbines Ltd works much like submerged windmills, but driven by flowing water rather than air. They can be installed in the sea at places with high tidal current velocities, or in places with fast enough continuous ocean currents, to take out copious quantities of energy from these huge volumes of flowing water.

The technology being deployed by MCT, known as “SeaGen” consists of twin axial flow rotors of 15m to 20m in diameter (the size depending on local site conditions), each driving a generator via a gearbox much like a hydro-electric turbine or a wind turbine. These turbines have a patented feature by which the rotor blades can be pitched through 180o in order to allow them to operate in bi-direction flows – that is on both the ebb and the flood tides. The twin power units of each system are mounted on wing-like extensions either side of a tubular steel monopile some 3m in diameter and the complete wing with its power units can be raised above sealevel to permit safe and reliable maintenance.

Recommended Book

The Leader’s Way

by Dalai Lama, Laurens van den Muyzenberg

Why am I writing this book now? Because I feel we all should have a sincere concern and responsibility for how the global economy operates, and an interest in the role of businesses in shaping our interconnectedness. Times have changed and I believe that leaders of religious traditions – with their ability to take a long view – should participate in discussions of global business and economics. Our world faces very serious problems. Those that are of particular concern to me include how to alleviate poverty in poor countries; the fact that even in prosperous countries the sense of satisfaction with life has been stagnating since 1950; the negative impact on the environment that is a result of negligence and of our ever-increasing population and rising standards of living; and, finally, the lack of peace in many parts of the world.

Because Buddhism takes a rational and logical attitude to such problems, its approach is sometimes easier to understand for those who are not religious. There is a stress on human values and particularly on the importance of motivation – how humans can be taught to take a holistic approach to solving society’s problems. This is an important contribution that Buddhism can make to these discussions. – Dalai Lama

Smart Cities

Professor William J. Mitchell, M.I.T.: “The research of the Smart Cities group focuses upon intelligent, sustainable buildings, mobility systems, and cities. It explores the application of new technologies to enabling urban energy efficiency and sustainability, enhanced opportunity and equity, and cultural creativity.

Buildings and cities can usefully be compared to living bodies. They have skeleton and skin systems that provide shelter and protection to their inhabitants, metabolic systems that process inputs of materials and energy to support daily life, and now artificial nervous systems consisting of sensors, networks, and ubiquitously embedded computational capacity. Smart Cities is particularly concerned with the emerging roles of networked intelligence in fabrication and construction, urban mobility, building design and intelligently responsive operation, and public space. It takes a broadly multidisciplinary approach, and is not constrained by traditional professional boundaries.”

CityCar

The CityCar is a stackable electric two-passenger city vehicle. The one-way sharable user model is designed to be used in dense urban areas. Vehicle Stacks will be placed throughout the city to create an urban transportation network that takes advantage of existing infrastructure such as subway and bus lines. By placing stacks in urban spaces and key points of convergence, the vehicle allows the citizens the flexibility to combine mass transit effectively with individualized mobility. The stack receives incoming vehicles and electrically charges them. Similar to luggage carts at the airport, users simply take the first fully charged vehicle at the front of the stack. The City car is NOT a replacement for personal vehicles, taxis, buses, or trucks; it is a NEW vehicle type that promotes a socially responsible and more effective means of urban mobility.

CityCar

The CityCar is a stackable electric two-passenger city vehicle. The one-way sharable user model is designed to be used in dense urban areas. Vehicle Stacks will be placed throughout the city to create an urban transportation network that takes advantage of existing infrastructure such as subway and bus lines. By placing stacks in urban spaces and key points of convergence, the vehicle allows the citizens the flexibility to combine mass transit effectively with individualized mobility. The stack receives incoming vehicles and electrically charges them. Similar to luggage carts at the airport, users simply take the first fully charged vehicle at the front of the stack. The City car is NOT a replacement for personal vehicles, taxis, buses, or trucks; it is a NEW vehicle type that promotes a socially responsible and more effective means of urban mobility.

Mobility-on-Demand

Mobility-on-Demand systems provide stacks and racks of light electric vehicles or bicycles at closely spaced intervals throughout a city. When you want to go somewhere, you simply walk to the nearest rack, swipe a card to pick up a vehicle, drive it to the rack nearest to your destination, and drop it off.

SmartBiking

The project, called SmartBiking, will utilize a novel self-organizing smart-tag system that will allow the city’s residents to exchange basic information and share their relative positioning with each other. The project will be implemented citywide in time for the November 2009 U.N. Climate Change Conference, which Copenhagen will host.”One of the most striking aspects of Copenhagen is that it is already a very sustainable city,” said Carlo Ratti, Director of MIT’s SENSEable City Lab, which is overseeing the Smart Biking project. “A considerable fraction of its energy comes from renewable sources and, unlike a few decades ago, 30 to 40 percent of its citizens use bicycles as their primary method of transportation.”

“We have developed a Facebook application called ‘I crossed your path,’ which creates a social network for cyclists, allowing them to link up with people they may have ridden past during the day and potentially establish new connections,” explains Christine Outram, the principal research assistant on the project.

The smart tags will also allow individuals to monitor the distance they travel while cycling, as part of a citywide “green mileage” initiative, which is similar to a frequent-flyer program. With the ‘green mileage’ scheme you could monitor how many miles you travel by biking and compare this with the CO2 emissions that you have not generated by taking the bus, a car or helicopter.

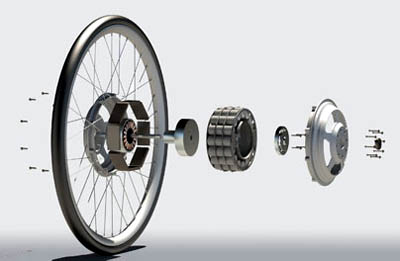

Picture: Exploded image of rear wheel of smart bicycle being developed in collaboration with the MIT Media Lab’s Smart Cities Group. A regenerative motor is used to harvest the energy created when braking and release it while cycling, in a manner similar to hybrid cars.

Futurist Portrait: Glen Hiemstra

Glen Hiemstra is a futurist speaker, futurist consultant, author, blogger, internet TV show host, and Founder of Futurist.com.

Glen Hiemstra is the founder and owner of Futurist.com, a company dedicated to disseminating information about the future in order to assist individuals, organizations and industries in creating the futures they prefer. An internationally respected futurist, Glen has advised professional, business, and governmental organizations for two decades. He is the author of Turning the Future into Revenue, from John Wiley & Sons, 2006, and is co-author of Strategic Leadership: Achieving Your Preferred Future.

As an expert in preferred future planning and a popular keynote speaker, Mr. Hiemstra zeros in on emerging trends in science, technology, economics, demographics, energy, the environment, and transportation. In his mind-stretching programs, Glen goes beyond simple trend analysis to discuss the opportunities that we all have to shape a future of hope and possibility.

Glen has worked with many leading companies, government agencies and organizations including Microsoft, Boeing, Adobe, Ernst & Young, PaineWebber, ShareBuilder, Ambrosetti (Italy), Club of Amsterdam, Northern Telecom, Home Depot, Weyerhaeuser, Hewlett Packard, Novo Nordisk, U.S./Mexico JWC, APAX Partners, Costa Rica Hotel Association, Atlanta 2060, Tulsa 2025, Idaho Transportation 2030, Federal Highway Administration Advanced Research, John Deere, and many others.

Glen has also served as a technical advisor for futuristic television programs, working with Steven Bochco Productions (creator of “LA Law” and “Hill Street Blues,”), among others. He has been quoted in The Wall Street Journal, Forbes, US News & World Report, The Futurist, and the Los Angeles Times. Glen was selected as one of 30 global leaders to advise on the design of the General Motors & Shanghai Automotive Industry pavilion for the Shanghai 2010 exhibition, and is a member of a similar team proposing a Global Solutions pavilion for Shanghai 2010.

In a first career, Glen was an award-winning professor and serves as a Visiting Scholar at the Human Interface Technology Lab at the University of Washington, which works on virtual and augmented reality technology.

Mr. Hiemstra was educated at Whitworth College, the University of Oregon, and the University of Washington. He lives in Kirkland, Washington with his wife Tracie. They have three adult children.

Agenda

Our Season Program 2008 / 2009!

| November 20, 2008 18:30 – 21:15 | the future of Values in Business Location: IBM Forum Amsterdam | |

| January 22, 2009 18:30 – 21:15 | the future of Beauty Location: AMFI – Amsterdam Fashion Institute | |

| Febuary 19, 2009 18:30 – 21:15 | the future of Creative Agencies Location: Platform 21, Prinses Irenestraat 19, 1077 WT Amsterdam | |

| March 19, 2009 18:30 – 21:15 | the future of the Brain Location: De Waag, Nieuwmarkt 4, 1012 CR Amsterdam [Center of the Nieuwmarkt] | |

| April 23,2009 18:30 – 21:15 | the future of Games Location: | |

| May 2009 | the future of BioMed | |

| June 2009 | the future of Connectivity Location: London |

Club of Amsterdam Open Business Club

Club of Amsterdam Open Business Club

Are you interested in networking, sharing visions, ideas about your future, the future of your industry, society, discussing issues, which are relevant for yourself as well as for the ‘global’ community? The future starts now – join ouronline platform …

Customer Reviews

Thanks for submitting your comment!